:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

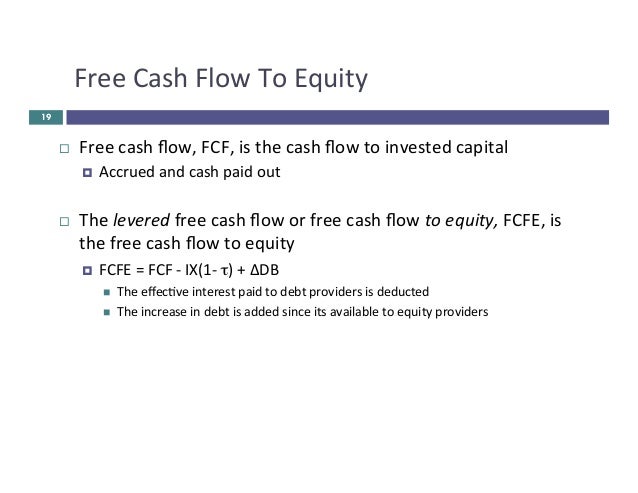

The amount of debt-sometimes referred to as “leverage”-affects the required loan payments. In a typical commercial real estate (CRE) transaction, the collection of capital used to finance the purchase consists of equity and debt. What Is Levered Cash Flow in Real Estate?Ī property’s levered cash flow is the amount of money left over after the property’s loan payments have been made. By comparing the properties based on their unlevered cash flow, the differences due to debt service are negated. For example, two properties could produce the exact same amount of unlevered cash flow, but the properties could have loans with different interest rates, terms, and amortization, which could result in very different performance after the loan payments have been made. In other words, unlevered cash flow is the amount of cash that a property produces as a result of its normal day-to-day operations.Īs a measure of a real estate property’s success, unlevered cash flow is important because it allows for the comparison of two properties on an operational basis only. In commercial real estate investing, unlevered cash flow is the amount of cash that a property produces before taking into account the effect of debt/loan payments. What is Unlevered Cash Flow in Real Estate?

Levered cash flow how to#

If you’re an accredited investor and want to learn more about how to invest in our world-class commercial real estate deals, click here. In this article, FNRP explains the difference between levered and unlevered cash flow in commercial real estate as well as the calculation of the Internal Rate of Return (IRR) and Cash-on-Cash Return metrics.įNRP is a private equity commercial real estate firm that creates risk-adjusted returns for our investors. When evaluating potential returns for a real estate investment, investors may often have to consider levered vs. Fundamentally, the value of a commercial real estate asset is derived from the amount of cash flow that the property produces.

0 kommentar(er)

0 kommentar(er)